29+ Debt payments to income ratio

When considering loan risks all lenders must consider this. DTI is 36 to 42.

Why Don T People Just Invest In Amazon Stocks Quora

To qualify for a USDA loan your total debt-to-income DTI ratio should be no more than 41.

. Ad For CA Residents Get Payoff Relief for 15000-150K Bills Without Bankruptcy or Loan. You shouldnt have trouble accessing new lines of credit. Some lenders like mortgage lenders generally require a debt ratio of 36 or less.

When it comes to DTI the lower the ratio the better Ulzheimer says. To express your ratio in percentage form multiply it. The debt-to-income ratio will be displayed as a percentage.

Your debt is likely manageable relative to your income. Ad Read This First Make a Smart Debt Choice. Gross debt service ratio This corresponds to the percentage of your gross income that goes towards.

Additionally your monthly housing-related expenses mortgage payments taxes. To calculate your DTI ratio divide your total monthly debt payments by your gross monthly income. Start Easy Request Online.

Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. The debt to income ratio is an important factor that can influence how much a home buyer is approved to borrow. The debt-to-income ratio DTI compares your monthly debt payments to your monthly income.

Example In our example Sams. Your monthly debt payments would be as follows. If your DTI becomes a concern you.

To calculate your debt-to-income ratio add up all your monthly debt payments and divide this by your monthly gross income. To calculate your debt-to-income ratio. Add up your monthly bills which may include.

The ratio is important to mortgage lenders because. The 43 rule is a debt-to-income ratio that is used to determine who qualifies for a loan and who does not. DTI is less than 36.

1200 400 400 2000. Generally an acceptable debt-to-income ratio should sit at or below 36. The debt-to-income ratio is derived by dividing monthly debt payments by monthly gross income before taxes.

Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money. If they had no debt thei See more. This is the percentage of your gross income required to cover your housing and debt payments.

To calculate it simply add up all of your debt. Ad Unbiased and Up-to-date Data on Family Debt Payments to Income Ratio. As a quick example if someones monthly income is 1000 and they spend 480 on debt each month their DTI ratio is 48.

Ad Compare Best Debt Consolidation Loans Companies 2022. When you divide the monthly payments by the gross monthly income the result you get will be a decimal. Then multiply the result by 100 to come up with a percent.

For example lets say you pay 1000 for your mortgage 500 for your car and. For example if your monthly income is 3000 and you have a car payment of 300 your. To calculate the ratio divide your monthly debt payments by your monthly income.

It means you can take on new debt more easily because you have the capacity to make the payments he. Example Total Monthly Debt Payments Rent or Mortgage Payments Minimum. Join 2 Million Residents Already Served.

See If You Qualify. To calculate your estimated. Called DTI for short your debt-to-income ratio is the percentage of your gross monthly income that goes toward debt payments.

This level of debt could. Debt-to-Income Ratio Use this calculator to quickly determine your debt-to-income ratio. 425 44 votes.

Free Quote From BBB A Rated Firms. Monthly rent or house payment Monthly alimony or child support payments Student auto. Apply Today Payoff Your Debt.

Lenders assess a persons debt-to-income ratio when considering loan. Debt to income ratio is the percentage of your monthly income that goes towards paying your debts. USDA loans set their limit at 29 for front-end-ratio and 41 for back-end-ratio but allow each lender to approve candidates with higher percentages if there are compensating factors such.

If your gross income for the month is 6000 your debt-to-income ratio would be 33 2000. The debt-to-income ratio can be calculated using these two formulas. Finally divide your total monthly debt payments by your monthly income to find out your DTI.

What Are Penny Stocks In Indian Market Which Has Great Potential In Future Quora

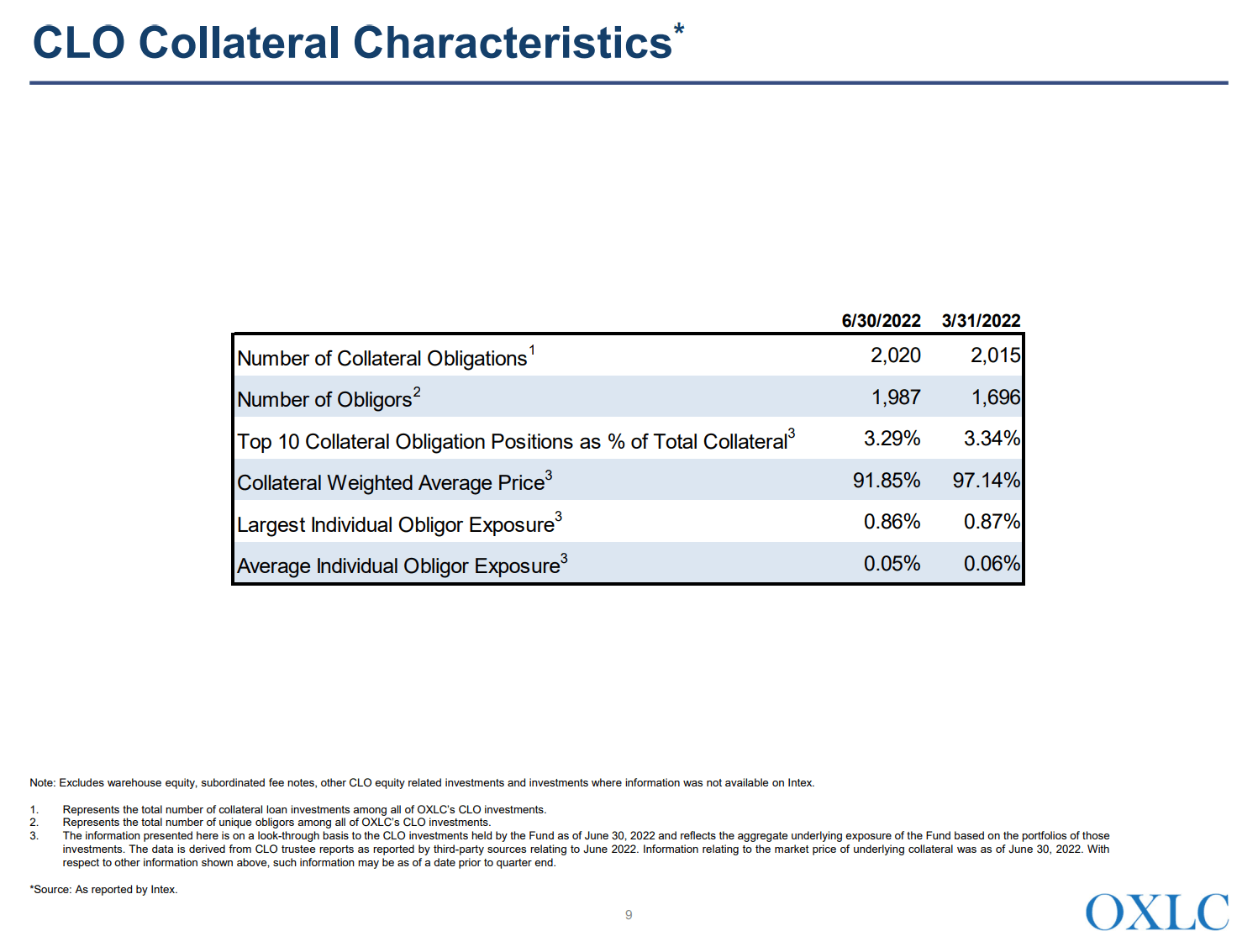

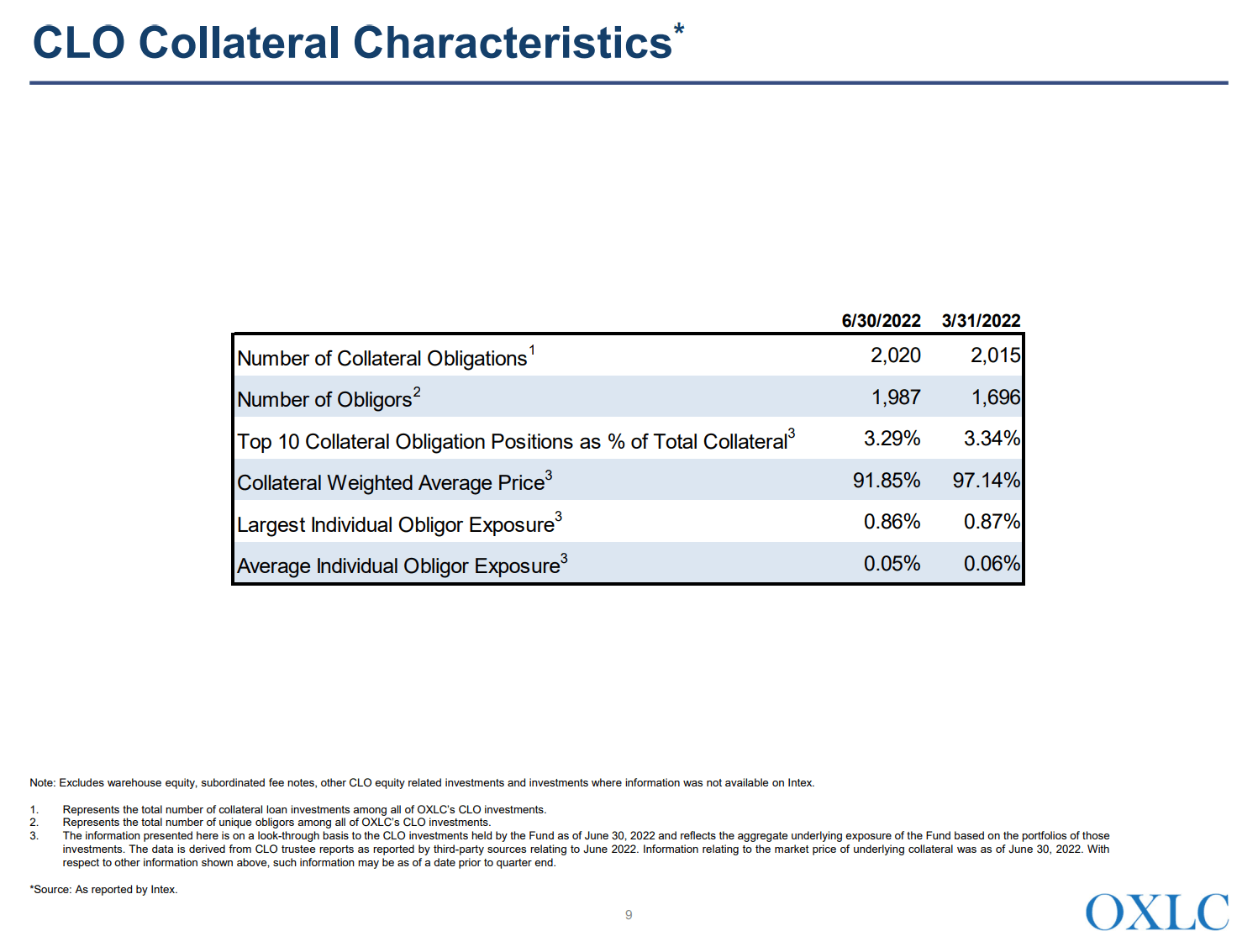

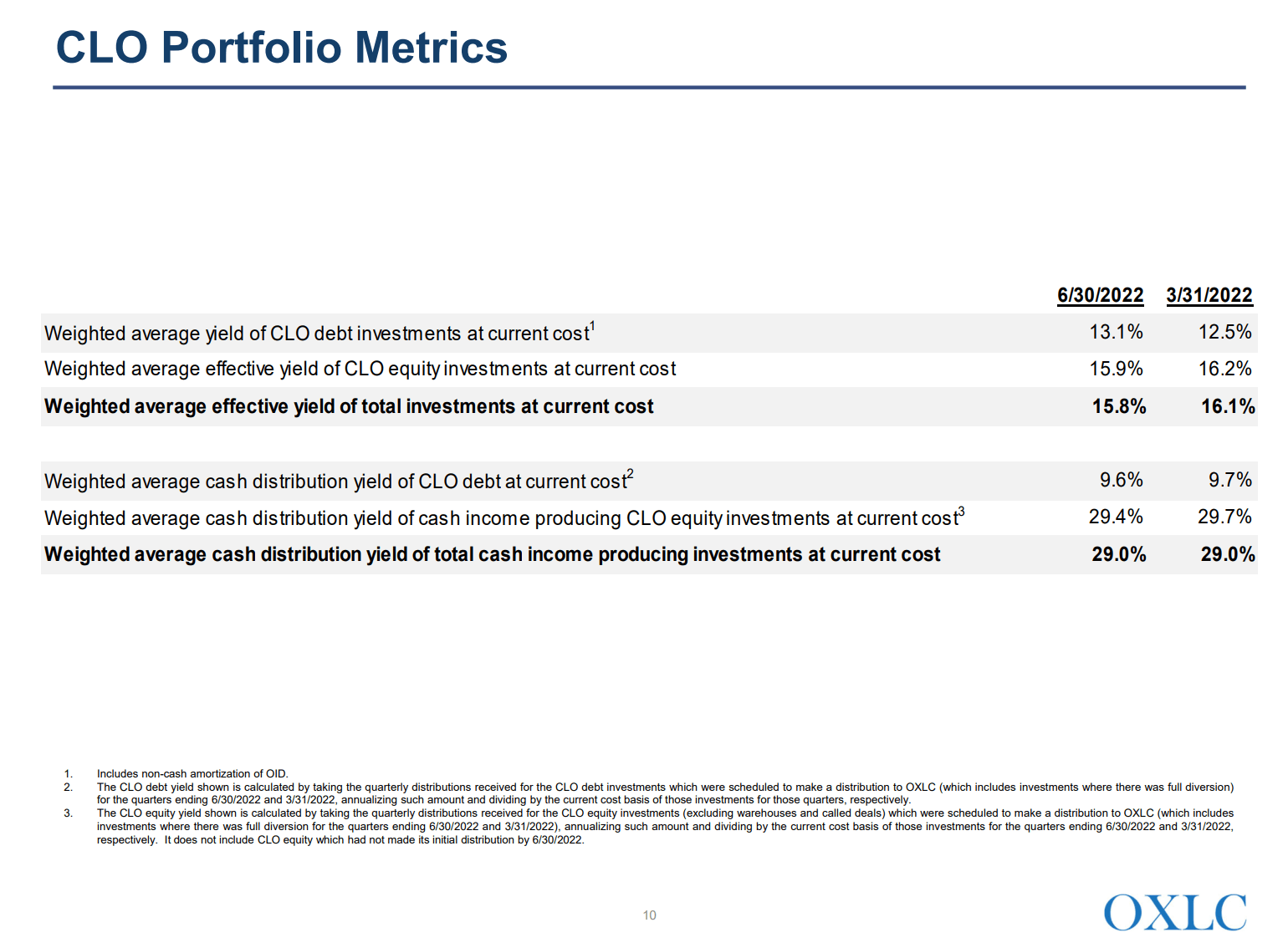

Oxford Lane Capital Stock Look Beyond The Yield Nasdaq Oxlc Seeking Alpha

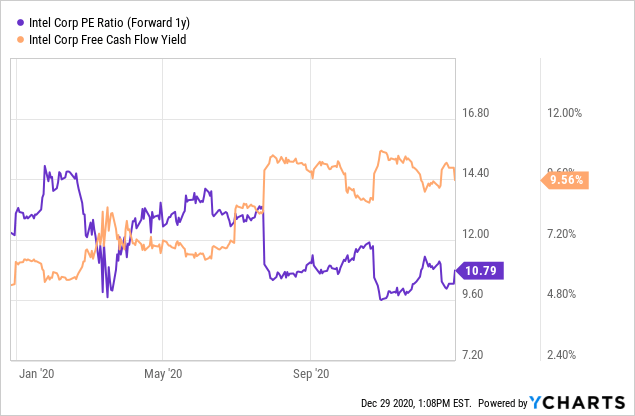

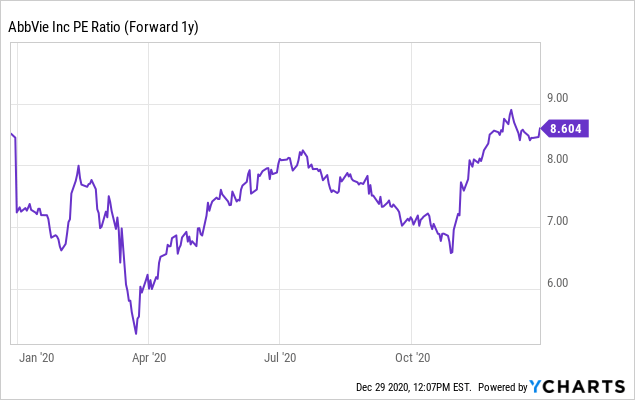

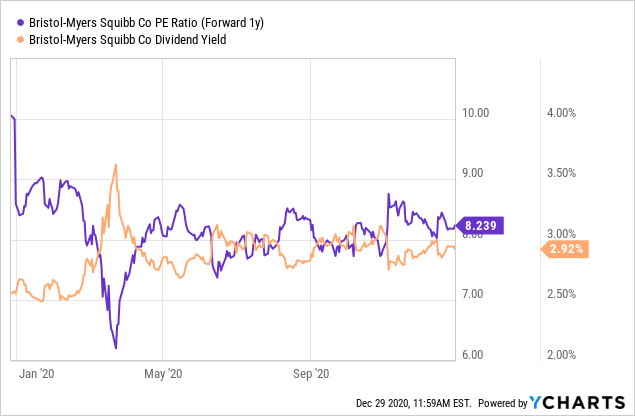

Top 10 Undervalued High Yield Income Stocks For 2021 Seeking Alpha

Oneok Strong Performance A New Era For Dividends Nyse Oke Seeking Alpha

Is Long Term Investing Always Safe Quora

Oxford Lane Capital Stock Look Beyond The Yield Nasdaq Oxlc Seeking Alpha

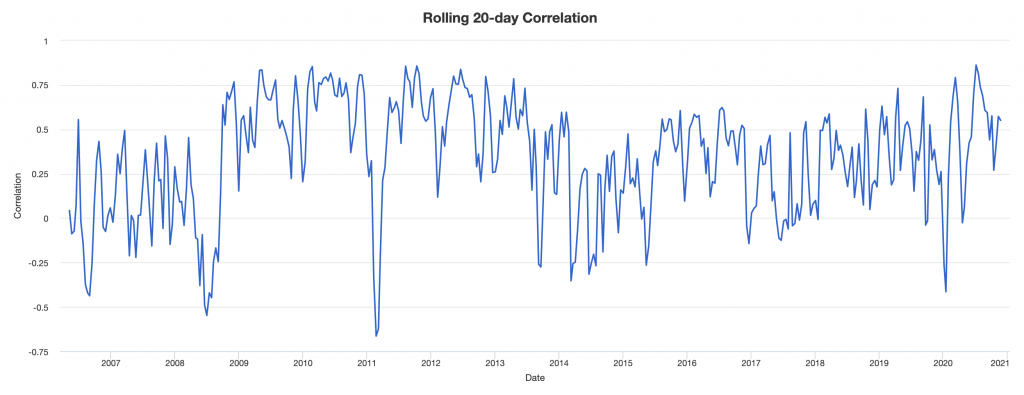

How To Improve Risk Adjusted Returns Daytrading Com

Drs

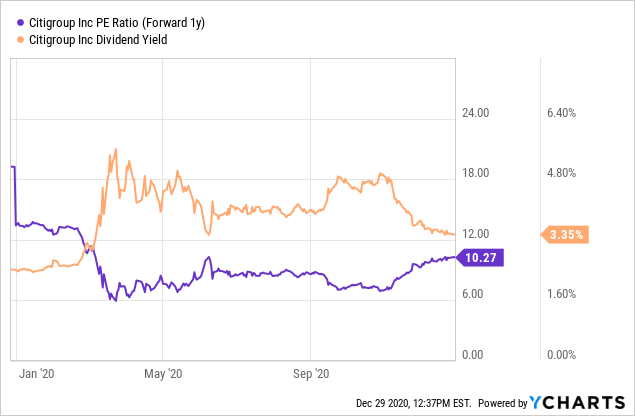

Top 10 Undervalued High Yield Income Stocks For 2021 Seeking Alpha

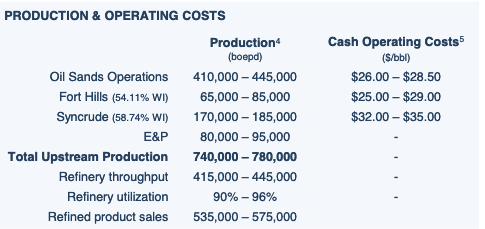

Suncor Energy A Safer Way To Play The Oil And Gas Rebound Nyse Su Seeking Alpha

Cash Conversion Cycle Ccc Formula

Oxford Lane Capital Stock Look Beyond The Yield Nasdaq Oxlc Seeking Alpha

Pay Stub Maker Online Free Paystub Maker Tool For Your Stubs Stubcreator Payroll Template Templates Good Credit

Top 10 Undervalued High Yield Income Stocks For 2021 Seeking Alpha

Understanding Bond Prices And Yields

Understanding Bond Prices And Yields Fixed Income

Top 10 Undervalued High Yield Income Stocks For 2021 Seeking Alpha